Are 50-Year Mortgages the Future of Homeownership?

🏡 Are 50-Year Mortgages the Future of Homeownership?

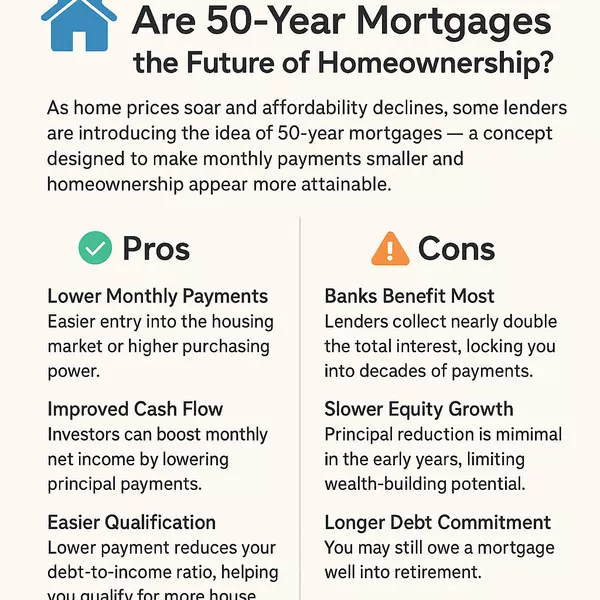

As home prices soar and affordability declines, some lenders are introducing the idea of 50-year mortgages — a concept designed to make monthly payments smaller and homeownership appear more attainable.

But stretching a mortgage half a century comes with trade-offs. Let’s break down what this means for buyers, banks, and investors — and compare a 30-year vs. 50-year mortgage side by side.

🔹 The Example

We’ll compare: 30-year fixed mortgage and 50-year fixed mortgage.

📊 Payment & Interest Comparison

| Loan Term | Monthly Payment (Principal & Interest) | Total Interest Paid | Total Paid (Principal + Interest) |

|---|---|---|---|

| 30-Year Mortgage | $1,763/month | $349,680 | $634,680 |

| 50-Year Mortgage | $1,563/month | $648,800 | $933,800 |

(rounded to nearest dollar)

💡 What the Numbers Show

- The 50-year mortgage lowers monthly payments by about $200, increasing affordability.

- But over the life of the loan, you’ll pay almost $300,000 more in interest.

- The bank effectively doubles its interest earnings by stretching the term — a clear win for lenders, not borrowers.

- Homeowners build equity much slower, meaning most payments go toward interest for decades.

✅ Pros of a 50-Year Mortgage

- Lower Monthly Payments – Easier entry into the housing market or higher purchasing power.

- Improved Cash Flow – Investors can boost monthly net income by lowering principal payments.

- Easier Qualification – Lower payment reduces your DTI, helping you qualify for more house.

- Short-Term Flexibility – Works for buyers planning to refinance or sell within 5–10 years.

⚠️ Cons of a 50-Year Mortgage

- Banks Benefit Most – Lenders collect nearly double the total interest, locking you into decades of payments.

- Slower Equity Growth – Principal reduction is minimal in the early years, limiting wealth-building potential.

- Longer Debt Commitment – You may still owe a mortgage well into retirement.

- Potentially Higher Rate – 50-year loans may come with a rate premium due to the longer risk horizon.

- Limited Availability – Not all lenders will offer such terms, especially with regulatory uncertainty.

💰 Investor Angle: Cash Flow vs. Depreciation

For real estate investors, a 50-year mortgage can improve monthly cash flow by reducing the mortgage payment, which could make rental properties more profitable in the short term.

However, there’s a potential trade-off:

- Residential real estate depreciation currently follows a 27.5-year schedule under IRS rules.

- If the concept of a 50-year ownership model evolves, some analysts speculate that future tax law could extend depreciation to match longer loan terms — potentially doubling it to around 50–56 years.

- That would reduce annual depreciation deductions, offsetting some of the cash flow benefit and making tax sheltering less effective over time.

In other words, while a 50-year mortgage helps your monthly cash flow, it may dilute long-term tax advantages.

🧮 Quick Takeaway

🏠 Final Thoughts

A 50-year mortgage may look attractive if you’re focused on monthly affordability or short-term investment cash flow, but the long-term implications heavily favor the banks.

Borrowers end up paying nearly $300,000 more in interest on a $300,000 home — essentially buying the same property twice.

Before committing to an ultra-long mortgage, consider your exit plan, potential refinancing options, and how much interest you’re really willing to give away for a slightly smaller monthly bill.

Recent Posts