Why November and December Are the Secret Sweet Spot for New Construction Home Buyers

Why November and December Are the Secret Sweet Spot for New Construction Home Buyers If you’ve ever wondered when the best time is to shop for a brand-new home, here’s a little secret: November and December could be your golden window. While most people are busy with holiday plans, savvy buyers are

Read MoreShould you buy a new home if currently have a mortgage below 4%

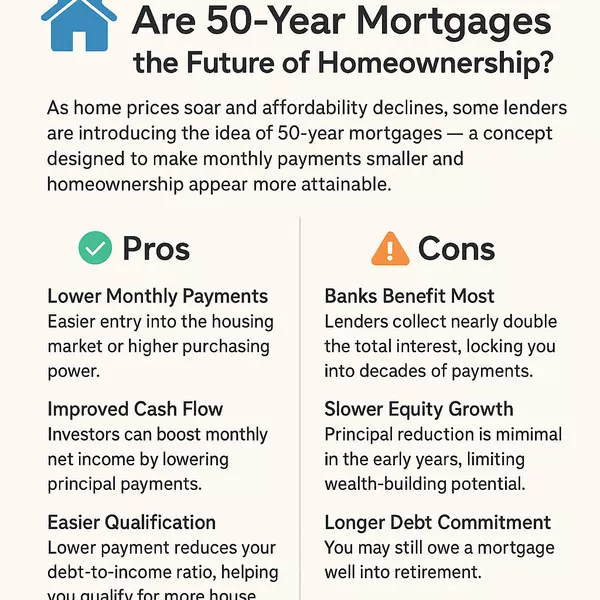

Navigating the Mortgage Landscape: A Look at Current Rates and Future Projections Introduction:In the ever-evolving landscape of homeownership, staying informed about mortgage rates is crucial for both current homeowners and potential buyers. Recent data reveals that a significant 59% of homeowners

Read MoreAre the holidays a good time to buy a new home?

The holiday season is upon us, and while many people are busy with festive celebrations and family gatherings, some savvy buyers might be wondering if this is actually a good time to buy a new home. Contrary to popular belief, the holidays can indeed be a great time to make a real estate purchase. I

Read MoreUnlocking Affordable Dreams: Exploring Rate Buydowns on New Homes

Title: Unlocking Affordable Dreams: Exploring Rate Buydowns on New Homes In the world of real estate, the decision to purchase a home is undoubtedly one of the most significant financial choices an individual or family can make. A central factor influencing this decision is the prevailing interest r

Read More

Recent Posts