-

Meet Prime Real Estate Solutions Group Brokered By EXP: Your Trusted Real Estate Experts in Bridgeland, Cypress, TX Looking for a reliable real estate professional in Bridgeland or Cypress, TX? Whether you’re buying your dream home or selling a property, finding the right partner can make all the di

Read More Rent-to-Own: Unlocking Homeownership Through Lease Purchase

Rent-to-Own: Unlocking Homeownership Through Lease Purchase Imagine finding your dream home, but you’re not quite ready to buy. Maybe you need to save a bit more for a down payment, or perhaps you want to test out the neighborhood before committing. That’s where rent-to-own, also known as lease purc

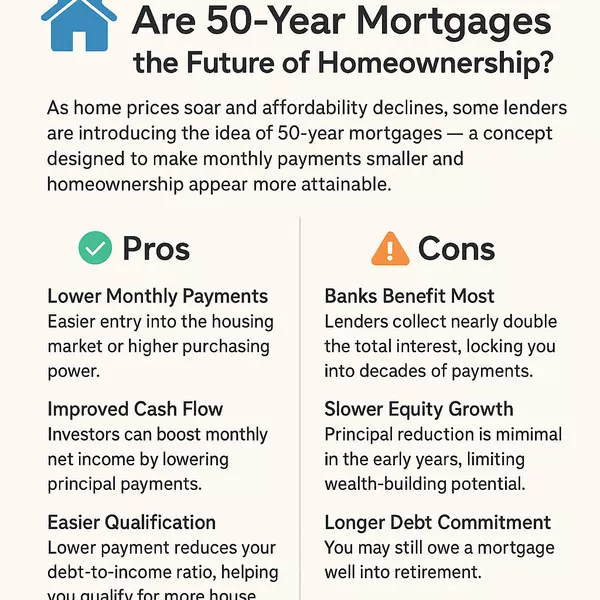

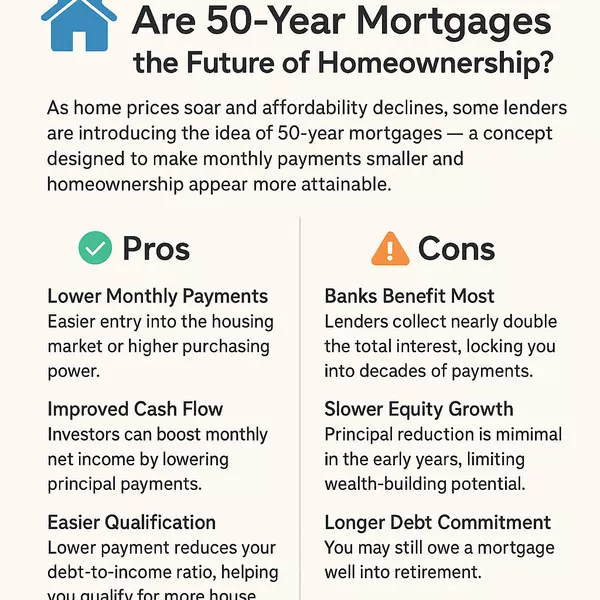

Read MoreAre 50-Year Mortgages the Future of Homeownership?

🏡 Are 50-Year Mortgages the Future of Homeownership? As home prices soar and affordability declines, some lenders are introducing the idea of 50-year mortgages — a concept designed to make monthly payments smaller and homeownership appear more attainable. But stretching a mortgage half a century

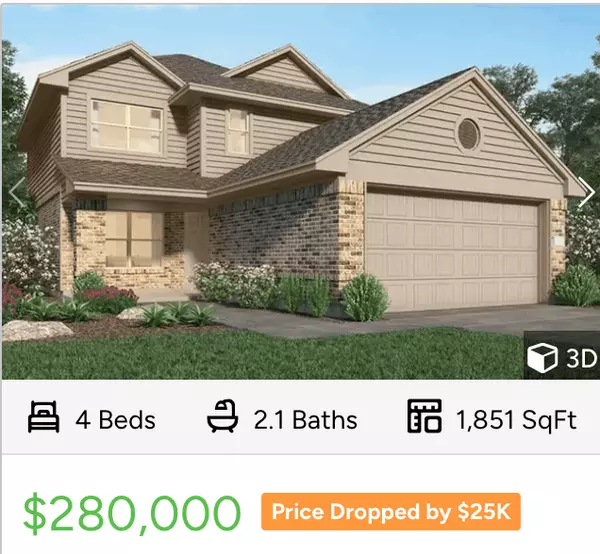

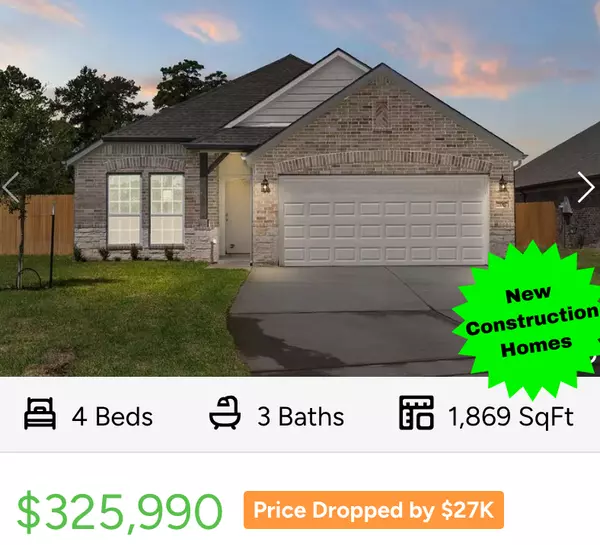

Read MoreWhy November and December Are the Secret Sweet Spot for New Construction Home Buyers

Why November and December Are the Secret Sweet Spot for New Construction Home Buyers If you’ve ever wondered when the best time is to shop for a brand-new home, here’s a little secret: November and December could be your golden window. While most people are busy with holiday plans, savvy buyers are

Read MoreUnderstanding Real Estate Commissions After August 2024

Understanding Real Estate Commissions After August 2024 Why Sellers Traditionally Paid 5–6% In the past, sellers paid a total of 5–6% in commissions, usually split 3% to the listing agent and 3% to the buyer’s agent.That covered marketing, photos, MLS listing, advertising, showings, contracts, and n

Read MoreSave Hundreds/Thousands on Your Property Taxes – File Your Homestead Exemption by April 30, 2025

Don’t Miss the Homestead Exemption Deadline in Harris County – April 30, 2025! If you bought a home in Harris County in 2024 and it’s now your primary residence, don’t leave money on the table—file for your Homestead Exemption before the April 30, 2025 deadline! 💰 Why the Homestead Exemption Matter

Read MoreDiscover Modern Comfort in Rosharon: 222 Kestrel LN

$284,990 4 Beds | 2 Baths | 2,091 SqFt 222 Kestrel LN, Rosharon, TX 77583 Active Looking for a home that combines convenience, comfort, and modern living? Look no further than 222 Kestrel LN in Rosharon, TX. This stunning residence offers everything you need and more, with a listing price of $284,99

Read MoreShould you buy a new home if currently have a mortgage below 4%

Navigating the Mortgage Landscape: A Look at Current Rates and Future Projections Introduction:In the ever-evolving landscape of homeownership, staying informed about mortgage rates is crucial for both current homeowners and potential buyers. Recent data reveals that a significant 59% of homeowners

Read More-

Don't Let the Chill Get the Chillin': Preparing Your House for a Hard Freeze (Without Bursting a Pipe) Ah, winter. Cozy sweaters, hot cocoa, and...frozen pipes? Brrr! The thought of icy plumbing and potential floods may send shivers down your spine, but fear not, fellow homeowner! With a little proa

Read More -

In recent months, the real estate market has seen a significant drop in mortgage rates, resulting in great news for prospective buyers. This week, mortgage rates have continued to plummet, averaging just over 7%. This decrease in rates presents an excellent opportunity for individuals looking to pur

Read More Are the holidays a good time to buy a new home?

The holiday season is upon us, and while many people are busy with festive celebrations and family gatherings, some savvy buyers might be wondering if this is actually a good time to buy a new home. Contrary to popular belief, the holidays can indeed be a great time to make a real estate purchase. I

Read MorePros and Cons of High interests Rates

For potential home buyers, the fluctuation of interest rates can make a significant impact on their decision-making process. High interest rates, in particular, can have both positive and negative effects on home buyers. Understanding these pros and cons can help buyers navigate through the real est

Read MoreUnlocking Affordable Dreams: Exploring Rate Buydowns on New Homes

Title: Unlocking Affordable Dreams: Exploring Rate Buydowns on New Homes In the world of real estate, the decision to purchase a home is undoubtedly one of the most significant financial choices an individual or family can make. A central factor influencing this decision is the prevailing interest r

Read MoreBuying a new construction home with a realtor

Buying a New Construction Home with a Realtor Buying a new construction home can be an exciting and rewarding experience. There are many benefits to purchasing a new home, including the ability to customize it to your liking and the assurance that everything is new and up-to-date. However, the proce

Read MoreSelling your home? what the market is like?

Selling Your Home? What the Market is Like?As a seller, it is important to understand the current market trends and update yourself with the latest real estate news before putting your property on the market. It is essential to know whether it is a good time to sell and what to expect from potential

Read MoreHow to sell a home that needs lots of repairs

Selling a home can be a stressful and emotional experience, especially if the property is considered "distressed." A distressed property is one that is in need of repairs or renovations, has a lien or encumbrance on it, or is facing foreclosure. Homeowners with distressed properties may feel overwhe

Read MoreShould you buy a home when interest rates are high?

Buying a home is one of the most significant financial decisions that one can make. It is a decision that requires careful consideration, especially in a market where interest rates are high, and home prices may drop. However, contrary to popular belief, buying a home during these times may be a wis

Read More

Recent Posts